Effective risk management is vital for proprietary trading firms, CFD brokers, and sweepstakes casinos. Each sector faces unique challenges and requires tailored solutions across three primary domains: Market (Financial) Risk Management, Operational Risk Management, and Compliance & Fraud Risk Management. This page explains how each industry can approach and optimize these core areas.

Position Sizing: Strict control over trade size and capital allocation to minimize potential losses.

Leverage Controls: Set maximum leverage limits to reduce risk exposure.

Real-Time Monitoring: Use advanced platforms to monitor trader activity and enforce risk limits instantly.

Automated Stop-Outs: Implement systems that automatically close positions after certain loss thresholds are met.

Trade Audit Trails: Keep detailed records of all trading activities and user actions for transparency and review.

System Reliability: Regularly stress-test trading platforms and have robust backup systems in place.

Business Continuity Planning: Develop and maintain disaster recovery strategies to protect data and trading activities.

KYC Protocols: Verify trader identities thoroughly to ensure legitimacy and regulatory compliance.

Monitoring for Insider Activity: Track for anomalous behavior that may indicate misuse of confidential information.

Data Security: Secure sensitive trader information through encryption and access controls.

Risk Engine Deployment: Use sophisticated software to continuously evaluate client exposures and total market risk.

Dynamic Hedging: Offset internal risk by hedging in external markets or with liquidity providers.

Negative Balance Protection: Ensure clients cannot owe more than their account balance regardless of market volatility.

Adjustable Margin Rates: Change margin requirements as market risk fluctuates to protect both broker and client.

Low-Latency Infrastructure: Invest in fast, reliable servers to prevent execution lags and trading interruptions.

Segregation of Duties: Allocate operational responsibilities to reduce the likelihood of errors or internal fraud.

Incident Handling Procedures: Document clear steps for addressing system outages, execution errors, and client disputes.

AML Systems: Implement automated checks to detect suspicious transactions and prevent money laundering.

Regulatory Reporting: Maintain up-to-date, transparent records to comply with local and international laws.

Client Verification: Enforce comprehensive account checks including identity documents and proof of address.

House Edge Adjustment: Regularly review game RTP (return to player) parameters to control the casino’s expected profit margin.

Win & Loss Limits: Cap the maximum potential payout and acceptable loss per user or group.

External Jackpot Insurance: Purchase insurance for high-value jackpots to limit financial exposure.

Fairness Audits: Use third-party organizations to verify randomness and fairness of games.

Scalable Technology: Build infrastructure that adapts to sudden surges in player traffic without downtime.

Responsible Gaming Features: Offer tools for voluntary self-exclusion and session limits.

Geo and Age Verification: Automatically exclude underage players and those from restricted locations by validating submitted information.

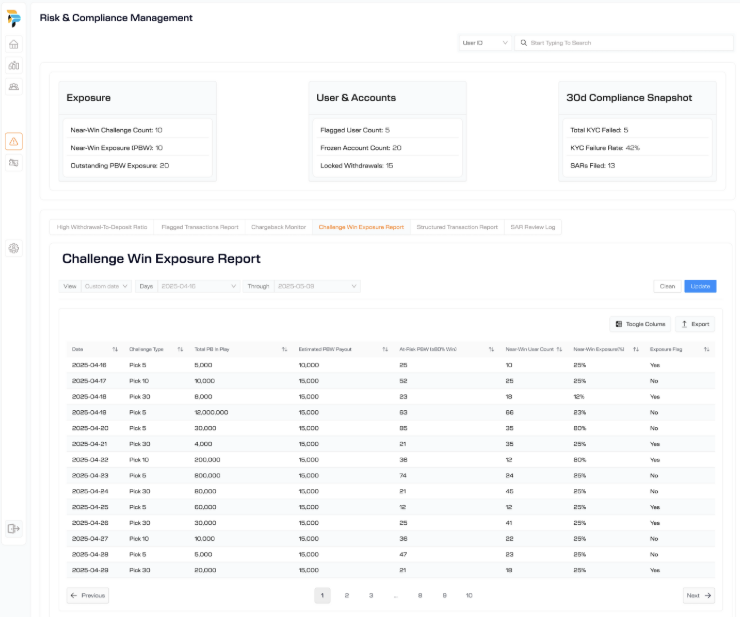

Bonus Abuse Monitoring: Track for multiple accounts and flag patterns consistent with promotional exploitation.

Adherence to Sweepstakes Laws: Continuously review and update policies to comply with all relevant gaming and sweepstakes regulations.

Data Encryption: Use encryption for sensitive data storage and transmission.

API Key Management: Store and rotate keys securely, and never expose them unnecessarily.

Regular Security Auditing: Conduct routine penetration testing and security reviews.

Role-Based Access: Only provide data/system access according to each team member’s role.

Incident Response Plans: Prepare and update breach and disaster recovery procedures regularly.

Automated Alerts: Set up real-time notifications for risk breaches, system anomalies, and suspicious activities.

Failover Mechanisms: Ensure backup systems and processes are ready for critical system failures.

Ongoing Monitoring: Review incidents promptly and update systems or policies to address emerging risks.

Each industry—prop trading, CFD brokerage, or sweepstakes gaming—faces distinctive risks. Comprehensive risk management, tailored to specific activities and regulatory environments, is essential to business resilience and reputation. By building multilayered protections in financial, operational, and compliance domains, your business can thrive safely and sustainably.

Take the First Step Towards Launching Your Prop Trading Firm Effortlessly.

Get In TouchFUTUREBRIDGE MARKETING AND CONSULTANCY - FZCO is dedicated to providing cutting-edge software solutions and consulting services. We would like to clearly state that our company does not engage in offering financial services, nor do we provide any form of financial advice. While we facilitate the establishment and operation of brokerages and firms through technological support and strategic consultation, all decisions made based on our services are at the discretion of our clients. It is recommended that clients seek independent financial advice where necessary.

CFD Risk Warning: Trading Contracts for Difference (CFDs) involves significant risk of loss and is not suitable for all investors. Please ensure you fully understand the risks involved.